Rumored Buzz on $255 Payday Loans Online Same Day

Table of ContentsA Biased View of $255 Payday Loans Online Same DayThe smart Trick of $255 Payday Loans Online Same Day That Nobody is DiscussingThe Main Principles Of $255 Payday Loans Online Same Day Facts About $255 Payday Loans Online Same Day RevealedThe Facts About $255 Payday Loans Online Same Day Revealed

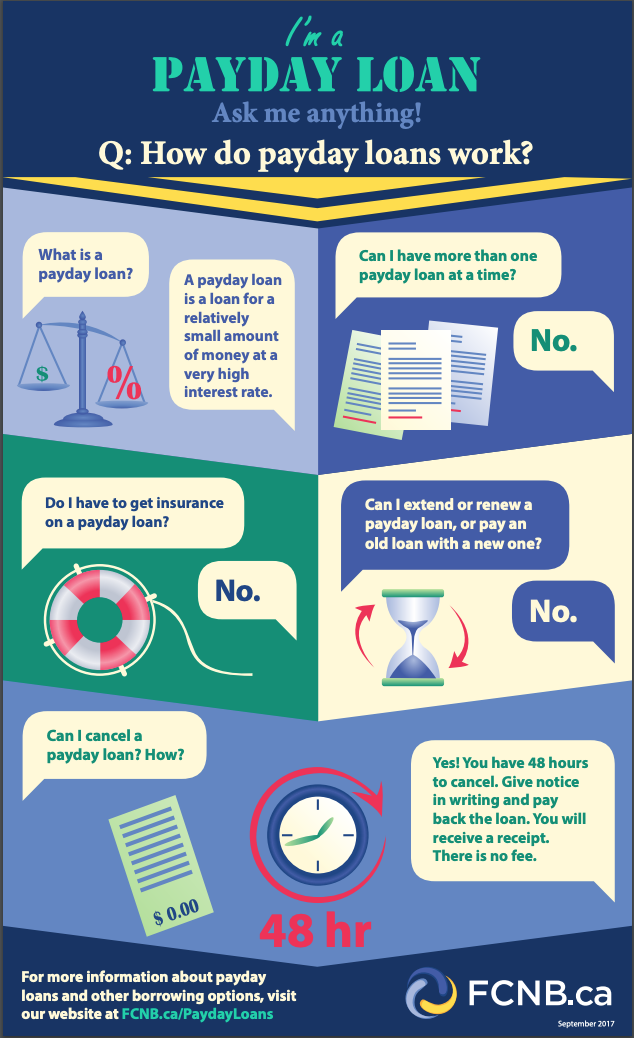

Payday advance are temporary money lendings based upon the borrower's personal check held for future deposit or on electronic access to the borrower's checking account. Consumers compose an individual look for the quantity obtained plus the finance fee and also receive cash. In some instances, borrowers transfer digital accessibility to their checking account to receive and settle payday advance loan.To pay a funding, customers can redeem the check by paying the car loan with cash, permit the check to be transferred at the financial institution, or just pay the financing fee to roll the financing over for an additional pay period. Some payday lending institutions also supply longer-term payday instalment lendings and request permission to online withdraw numerous payments from the customer's bank account, commonly due on each pay date.

The average financing term has to do with two weeks. Loans generally set you back 400% yearly interest (APR) or much more. The money fee varies from $15 to $30 to obtain $100. For two-week financings, these financing fees cause rates of interest from 390 to 780% APR. Shorter term finances have also greater APRs.

All a customer needs to get a payday advance is an open savings account in fairly good standing, a stable income source, and also recognition. Lenders do not carry out a full debt check or ask concerns to determine if a borrower can afford to pay off the funding. Because fundings are made based upon the lending institution's capacity to collect, not the debtor's capability to pay back while fulfilling various other financial commitments, cash advance develop a financial obligation catch.

The Basic Principles Of $255 Payday Loans Online Same Day

Borrowers default on one in five payday lendings. Cash advance financings are made by payday loan shops, or at shops that sell other financial services, such as check cashing, title financings, rent-to-own and pawn, depending on state licensing needs.

CFPB located 15,766 payday advance shops running in 2015. High cost payday financing is accredited by state laws or laws in thirty-two states. Fifteen states and also the Area of Columbia secure their customers from high-cost cash advance borrowing with sensible little loan price caps or various other prohibitions. Three states established lower rate caps or longer terms for rather less expensive car loans.

Payday finances are not permitted for active-duty service participants and also their dependents. Division of Protection policies use to finances subject to the federal Fact in Loaning Act, consisting of payday and also title financings.

The Consumer Financial Protection Bureau imposes the MLA guidelines. To submit a complaint, click below. See: CFA press launch on revised MLA rules.

The Only Guide for $255 Payday Loans Online Same Day

Brilliant yellow and also red indicators with promises of instantaneous money to aid you get to cash advance. Yupwe're talking about cash advance lending institutions.

What you really obtain is a little cash advance lending and also a heap of hot, steaming, lousy financial obligation. What do you do when you're down on your luck, living paycheck to paycheck, have inadequate credit report, and also that squeaky wheel on your auto not just diminishes yet blows up and also you don't have the cash to cover it? Where do you transform? Payday advance are loans that help you get from one payday to the next (for those times your paycheck can't extend to the end of the month) - $255 Payday loans online same day.

And also to cover everything off, Robert's credit rating is shot, and also all of his bank Learn More card are maxed out. Feeling hopeless, Robert drives to his neighborhood cash advance loan provider, skims the finance agreement (ideal past the huge rate of interest price), as well as signs his name on the dotted line for $300.

In order for the lending institution to look previous his repayment history (or lack thereof) and poor credit report, Robert needs to create a check dated for his check here next cash advance in the quantity he borrowedplus passion. Yet what he does not understand is that by joining to obtain money quickly, he just made a gent's contract with the financial debt evil one.

The Best Guide To $255 Payday Loans Online Same Day

At a 15% interest rate for a two-week lending period, he racked up $45 in interest. He couldn't pay it back in 2 weeks, so he determined to expand the financing (for an additional cost of training course).

At the end of the cycle, Robert will have just borrowed $300 however paid $105 in passion as well as charges to the loan provider. That's 35% interesta 912. 50% annual rates of interest. Yikes. Pay attention up: Payday loan providers are the monetary industry's mobsters. They provide a remedy to take care of an issue. But right when you assume you run out the woods, they come knockingthey desire their cash.

You see, when you register for a payday advance, you give the lender access to your examining account so they can subtract what they're owed (plus a charge) on paydayor you have to write them a post-dated check.1 That's just how they recognize you're excellent for the cash. Payday lending institutions do not really care whether you can pay your bills or otherwise.

And to top everything off, Robert's credit history is fired, as well as all of his bank card are maxed out. Feeling desperate, Robert drives you can try this out to his local payday loan provider, skims the financing agreement (appropriate past the expensive rate of interest), and also indicators his name on the dotted line in exchange for $300 ($255 Payday loans online same day).

Some Known Details About $255 Payday Loans Online Same Day

In order for the loan provider to look previous his settlement history (or do not have thereof) as well as poor credit report, Robert has to write a check dated for his following cash advance in the quantity he borrowedplus rate of interest. What he does not recognize is that by signing up to get cash money quickly, he simply made a gentleman's agreement with the debt adversary.

At a 15% rate of interest rate for a two-week funding period, he racked up $45 in rate of interest. He couldn't pay it back in 2 weeks, so he made a decision to expand the car loan (for an additional fee of program).

At the end of the cycle, Robert will certainly have just obtained $300 however paid $105 in rate of interest and fees to the lender. 50% annual interest rate. Pay attention up: Cash advance loan providers are the financial industry's mobsters.

You see, when you enroll in a cash advance financing, you offer the loan provider access to your examining account so they can subtract what they're owed (plus a charge) on paydayor you have to create them a post-dated check.1 That's just how they understand you're good for the cash. Cash advance loan providers don't in fact care whether you can pay your expenses or not.